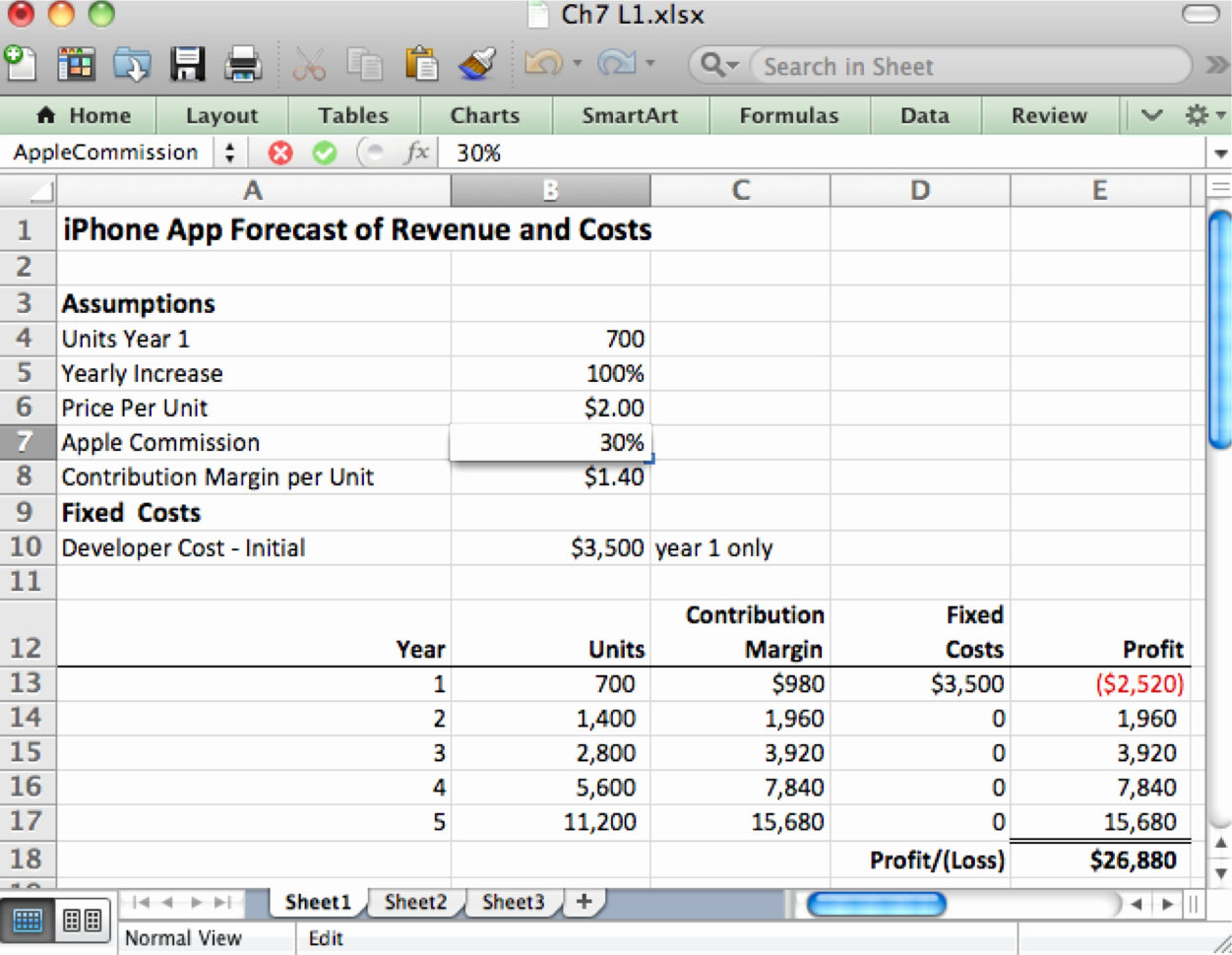

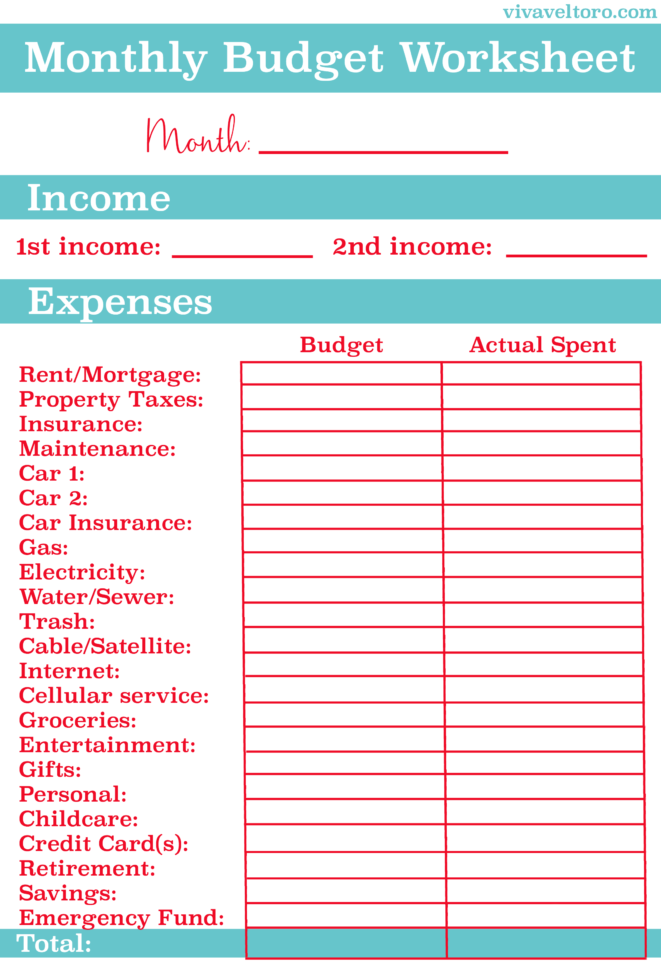

You may also find that you’re spending more than you want on a service or on a particular habit. If so, you can cancel the service and keep more money in the bank. Using a tracker allows you to fully see where you have room for improvement in your budget - and where you’re doing really well.Īfter doing a deep dive into your monthly expenditures (especially those you’ve set up on autopay and might’ve forgotten about), you may find that you’re paying for a service that you don’t even use, like a streaming platform or a gym membership. Doing this requires honesty, discipline and perseverance, even if you have a month with your spending that you’re not proud of. Tracking your spending and your income in a spreadsheet or app can reveal all the details about your day-to-day financial habits. This is key if you’re working towards saving for short-term goals like a vacation or long-term goals like establishing an emergency fund. And when those areas are things you can cut back on, like a daily coffee or multiple restaurant visits a week, you can use this information to modify your habits and keep more money in your bank account. By analyzing how much money you’re spending and where you’re spending it, you’ll start to notice areas where you’re doling out more than you really want to. Help in Reaching Your Financial Goals Photo Courtesy: PeopleImages/Getty ImagesĪn income and expense worksheet can help you learn to better manage your money, which is certainly important if you want to reach your financial goals. Whereas budgeting can feel a bit aspirational, this tool paints a clear picture of your spending habits, and can ultimately tell you where you need to cut back and where you’re already meeting your budgeting goals. The most important function of an income and expense worksheet is enabling you to see how you spent funds in a given period of time. You can also take note of how much income you made, including your primary source of income and potentially any income from side sources. Much like you would with a budget, you can group your income and expenses into certain categories (job, home, car, entertainment) with this type of tracker. Doing this puts you face to face with what comes in and what goes out in a given month, and it can help you make tweaks to your budget so it works better for your needs. Every time you earn or spend money, you log the amount in your worksheet, no matter what it is - from a big utility bill to a small snack purchase from the gas station. That’s where an income and expense worksheet comes in. But sometimes you can’t follow your budget - simply due to life circumstances. If you don’t follow your budget, you can end up between a rock and a financial hard spot. Or maybe you enjoyed some retail therapy, and just spent more than you anticipated on ordering food or shopping for hobby supplies. The issue that can arise with budgeting, though, is that things don’t always go according to even the best-laid plans.Įverything might be smooth sailing, with your expenses exactly matching what you anticipated in the budget, or you might experience an emergency expense that pushes your budget off track.

Income-Expense Basics: Keeping Track of Your Actual Spending Photo Courtesy: Geber86/Getty ImagesĪ budget breaks down how much money you intend (or can afford) to spend each month on housing, utilities, groceries and other expenses. With this in mind, let’s dive into what an income and expense worksheet is and how it can help you reach your financial goals. When you do, you can improve your money management and make more informed financial decisions for your future. It’s important to have both your budget and an income and expense tracker for keeping a record of your money moves. While a budget can help you plan for the future, this worksheet can show you what you’re really doing with your money right now - not later on. But another essential (and often overlooked) budgeting tool you’ll want to start using is an income and expense worksheet. Having a budget is vital, which you probably already know. Setting a budget means setting financial goals, too, and it’s one of the first steps you’ll take towards making decisions about what you want to do with your money. It’s what serves as a foundation to help you plan for the future by keeping your spending in check and your savings on track. When you think of personal financial planning and money management, the first thing that might come to mind is that you’ll need to establish a clear budget.

Photo Courtesy: Stígur Már Karlsson/Heimsmyndir/Getty Images

0 kommentar(er)

0 kommentar(er)